What Is The Sales Tax In Norwalk Ca . The december 2020 total local sales tax rate. This is the total of state, county, and city sales tax. The 2024 sales tax rate in norwalk is 10.5%, and consists of 6% california. zip code 90650 is located in norwalk, california. you may also call the local california department of tax and fee administration office nearest you for assistance. This county tax rate applies to areas. Go to the california city &. the sales tax rate in norwalk is 10.25%, and consists of 6% california state sales tax, 0.25% los angeles county sales tax,. the minimum combined 2024 sales tax rate for norwalk, california is 10.25%. the 10.25% sales tax rate in norwalk consists of 6% california state sales tax, 0.25% los angeles county sales tax,. california department of tax and fee administration cities, counties, and tax rates. discover our free online 2024 us sales tax calculator specifically for norwalk, california residents. the current total local sales tax rate in norwalk, ca is 10.250%.

from pbn.com

The 2024 sales tax rate in norwalk is 10.5%, and consists of 6% california. the sales tax rate in norwalk is 10.25%, and consists of 6% california state sales tax, 0.25% los angeles county sales tax,. the current total local sales tax rate in norwalk, ca is 10.250%. california department of tax and fee administration cities, counties, and tax rates. The december 2020 total local sales tax rate. This county tax rate applies to areas. Go to the california city &. discover our free online 2024 us sales tax calculator specifically for norwalk, california residents. you may also call the local california department of tax and fee administration office nearest you for assistance. the minimum combined 2024 sales tax rate for norwalk, california is 10.25%.

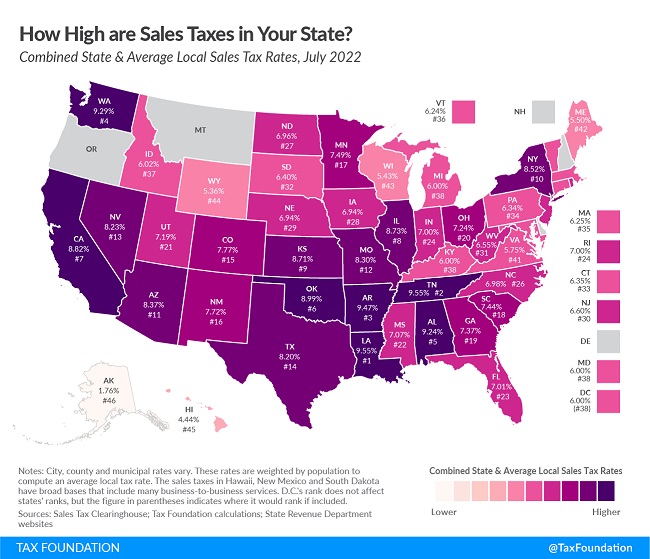

Tax Foundation R.I. state sales tax second highest in country

What Is The Sales Tax In Norwalk Ca This county tax rate applies to areas. This county tax rate applies to areas. zip code 90650 is located in norwalk, california. you may also call the local california department of tax and fee administration office nearest you for assistance. Go to the california city &. the sales tax rate in norwalk is 10.25%, and consists of 6% california state sales tax, 0.25% los angeles county sales tax,. the 10.25% sales tax rate in norwalk consists of 6% california state sales tax, 0.25% los angeles county sales tax,. This is the total of state, county, and city sales tax. discover our free online 2024 us sales tax calculator specifically for norwalk, california residents. california department of tax and fee administration cities, counties, and tax rates. The december 2020 total local sales tax rate. The 2024 sales tax rate in norwalk is 10.5%, and consists of 6% california. the minimum combined 2024 sales tax rate for norwalk, california is 10.25%. the current total local sales tax rate in norwalk, ca is 10.250%.

From mirnaymicheline.pages.dev

What Is California Sales Tax 2024 Tobey Pegeen What Is The Sales Tax In Norwalk Ca the 10.25% sales tax rate in norwalk consists of 6% california state sales tax, 0.25% los angeles county sales tax,. california department of tax and fee administration cities, counties, and tax rates. The december 2020 total local sales tax rate. zip code 90650 is located in norwalk, california. the current total local sales tax rate in. What Is The Sales Tax In Norwalk Ca.

From www.researchgate.net

Sales Taxes in Canada Download Table What Is The Sales Tax In Norwalk Ca you may also call the local california department of tax and fee administration office nearest you for assistance. This county tax rate applies to areas. discover our free online 2024 us sales tax calculator specifically for norwalk, california residents. the minimum combined 2024 sales tax rate for norwalk, california is 10.25%. the current total local sales. What Is The Sales Tax In Norwalk Ca.

From www.lao.ca.gov

Understanding California’s Sales Tax What Is The Sales Tax In Norwalk Ca This is the total of state, county, and city sales tax. the 10.25% sales tax rate in norwalk consists of 6% california state sales tax, 0.25% los angeles county sales tax,. the sales tax rate in norwalk is 10.25%, and consists of 6% california state sales tax, 0.25% los angeles county sales tax,. The 2024 sales tax rate. What Is The Sales Tax In Norwalk Ca.

From www.nancyonnorwalk.com

Norwalk tax sale already called a success Nancy on Norwalk What Is The Sales Tax In Norwalk Ca Go to the california city &. zip code 90650 is located in norwalk, california. The 2024 sales tax rate in norwalk is 10.5%, and consists of 6% california. the minimum combined 2024 sales tax rate for norwalk, california is 10.25%. The december 2020 total local sales tax rate. the 10.25% sales tax rate in norwalk consists of. What Is The Sales Tax In Norwalk Ca.

From www.patriotsoftware.com

Sales Tax vs. Use Tax How They Work, Who Pays, & More What Is The Sales Tax In Norwalk Ca discover our free online 2024 us sales tax calculator specifically for norwalk, california residents. the 10.25% sales tax rate in norwalk consists of 6% california state sales tax, 0.25% los angeles county sales tax,. The december 2020 total local sales tax rate. Go to the california city &. the sales tax rate in norwalk is 10.25%, and. What Is The Sales Tax In Norwalk Ca.

From pbn.com

Tax Foundation R.I. state sales tax second highest in country What Is The Sales Tax In Norwalk Ca The 2024 sales tax rate in norwalk is 10.5%, and consists of 6% california. the minimum combined 2024 sales tax rate for norwalk, california is 10.25%. the sales tax rate in norwalk is 10.25%, and consists of 6% california state sales tax, 0.25% los angeles county sales tax,. discover our free online 2024 us sales tax calculator. What Is The Sales Tax In Norwalk Ca.

From lao.ca.gov

June 2017 State Tax Collections [EconTax Blog] What Is The Sales Tax In Norwalk Ca zip code 90650 is located in norwalk, california. discover our free online 2024 us sales tax calculator specifically for norwalk, california residents. the minimum combined 2024 sales tax rate for norwalk, california is 10.25%. The 2024 sales tax rate in norwalk is 10.5%, and consists of 6% california. The december 2020 total local sales tax rate. . What Is The Sales Tax In Norwalk Ca.

From www.universalcpareview.com

Why is sales tax considered pass through for a company? Universal CPA Review What Is The Sales Tax In Norwalk Ca you may also call the local california department of tax and fee administration office nearest you for assistance. the minimum combined 2024 sales tax rate for norwalk, california is 10.25%. the current total local sales tax rate in norwalk, ca is 10.250%. Go to the california city &. This county tax rate applies to areas. the. What Is The Sales Tax In Norwalk Ca.

From parkvillemo.gov

Ballot Questions April 2023 What Is The Sales Tax In Norwalk Ca the 10.25% sales tax rate in norwalk consists of 6% california state sales tax, 0.25% los angeles county sales tax,. the sales tax rate in norwalk is 10.25%, and consists of 6% california state sales tax, 0.25% los angeles county sales tax,. This is the total of state, county, and city sales tax. california department of tax. What Is The Sales Tax In Norwalk Ca.

From www.taxjar.com

How to File a California Sales Tax Return TaxJar What Is The Sales Tax In Norwalk Ca The 2024 sales tax rate in norwalk is 10.5%, and consists of 6% california. discover our free online 2024 us sales tax calculator specifically for norwalk, california residents. This county tax rate applies to areas. the current total local sales tax rate in norwalk, ca is 10.250%. zip code 90650 is located in norwalk, california. The december. What Is The Sales Tax In Norwalk Ca.

From www.nancyonnorwalk.com

Norwalk tax sale already called a success Nancy on Norwalk What Is The Sales Tax In Norwalk Ca you may also call the local california department of tax and fee administration office nearest you for assistance. zip code 90650 is located in norwalk, california. The 2024 sales tax rate in norwalk is 10.5%, and consists of 6% california. discover our free online 2024 us sales tax calculator specifically for norwalk, california residents. Go to the. What Is The Sales Tax In Norwalk Ca.

From www.taxjar.com

How to File a California Sales Tax Return TaxJar What Is The Sales Tax In Norwalk Ca The 2024 sales tax rate in norwalk is 10.5%, and consists of 6% california. Go to the california city &. the sales tax rate in norwalk is 10.25%, and consists of 6% california state sales tax, 0.25% los angeles county sales tax,. This is the total of state, county, and city sales tax. This county tax rate applies to. What Is The Sales Tax In Norwalk Ca.

From taxfoundation.org

To What Extent Does Your State Rely on Sales Taxes? What Is The Sales Tax In Norwalk Ca the sales tax rate in norwalk is 10.25%, and consists of 6% california state sales tax, 0.25% los angeles county sales tax,. the minimum combined 2024 sales tax rate for norwalk, california is 10.25%. Go to the california city &. The december 2020 total local sales tax rate. This is the total of state, county, and city sales. What Is The Sales Tax In Norwalk Ca.

From www.nancyonnorwalk.com

Norwalk tax sale, August concerts and grants for women's businesses Nancy on Norwalk What Is The Sales Tax In Norwalk Ca zip code 90650 is located in norwalk, california. california department of tax and fee administration cities, counties, and tax rates. the sales tax rate in norwalk is 10.25%, and consists of 6% california state sales tax, 0.25% los angeles county sales tax,. discover our free online 2024 us sales tax calculator specifically for norwalk, california residents.. What Is The Sales Tax In Norwalk Ca.

From www.logistis.us

California Sales Tax Updates Logistis What Is The Sales Tax In Norwalk Ca The 2024 sales tax rate in norwalk is 10.5%, and consists of 6% california. This county tax rate applies to areas. discover our free online 2024 us sales tax calculator specifically for norwalk, california residents. This is the total of state, county, and city sales tax. you may also call the local california department of tax and fee. What Is The Sales Tax In Norwalk Ca.

From robertkerr.pages.dev

What Is California State Sales Tax 2025 Robert Kerr What Is The Sales Tax In Norwalk Ca discover our free online 2024 us sales tax calculator specifically for norwalk, california residents. you may also call the local california department of tax and fee administration office nearest you for assistance. the sales tax rate in norwalk is 10.25%, and consists of 6% california state sales tax, 0.25% los angeles county sales tax,. This is the. What Is The Sales Tax In Norwalk Ca.

From www.lao.ca.gov

Understanding California’s Sales Tax What Is The Sales Tax In Norwalk Ca you may also call the local california department of tax and fee administration office nearest you for assistance. the current total local sales tax rate in norwalk, ca is 10.250%. the sales tax rate in norwalk is 10.25%, and consists of 6% california state sales tax, 0.25% los angeles county sales tax,. Go to the california city. What Is The Sales Tax In Norwalk Ca.

From www.blog.rapidtax.com

California Tax RapidTax What Is The Sales Tax In Norwalk Ca the 10.25% sales tax rate in norwalk consists of 6% california state sales tax, 0.25% los angeles county sales tax,. you may also call the local california department of tax and fee administration office nearest you for assistance. Go to the california city &. the minimum combined 2024 sales tax rate for norwalk, california is 10.25%. . What Is The Sales Tax In Norwalk Ca.